Have you ever walked out of a store or clicked “checkout” online, only to wonder, “Why on earth did I just buy that?” If so, you’re not alone. The psychology of spending plays a huge role in our daily lives, often tricking us into purchases that feel good in the moment but leave us with regret later.

From grabbing that extra coffee on the way to work, to splurging on gadgets you don’t really need, our spending habits are deeply tied to emotions. And here’s the kicker: most of the time, it’s not about what we’re buying, it’s about how we’re feeling.

In this article, we’ll unpack the emotional triggers behind spending, why regret follows us home, and how understanding the psychology of spending can transform the way you think about money.

Why Emotions Drive Purchases More Than Logic

When you’re in the middle of a purchase, logic usually takes a back seat. Emotions — excitement, stress, even boredom — push us toward decisions we wouldn’t make otherwise.

Marketers know this well. Ads are designed to make you feel something: joy, nostalgia, or even FOMO (fear of missing out). That’s why even the most budget-conscious person can fall into the trap of impulse buying.

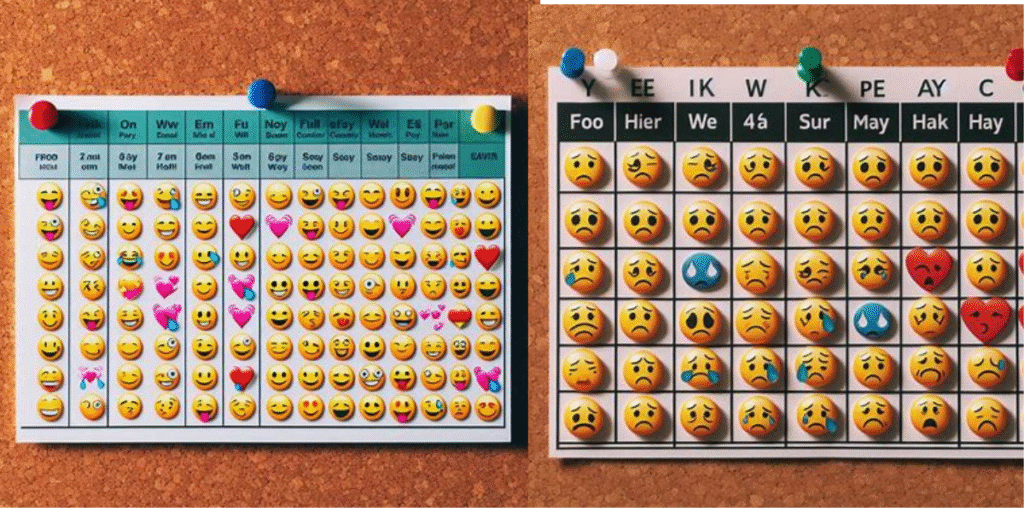

The psychology of spending teaches us that emotions like happiness, anxiety, or loneliness can open the door to purchases that give a temporary high but often come with a long-term letdown.

The Most Common Emotional Triggers Behind Spending

1. Stress Spending

We often buy things as a way to cope with stress. After a tough day, that “treat yourself” moment feels deserved. But over time, this habit can drain your finances.

2. The Happiness Boost

Retail therapy is real — shopping activates the brain’s reward center, giving us a dopamine rush. It feels amazing in the moment but fades quickly, leaving regret behind.

3. Boredom Buying

Scrolling through online shops when you’re bored? You’re not alone. The psychology of spending shows that boredom can make us crave stimulation, and shopping fills that void.

4. Social Influence

Friends, influencers, and even coworkers subtly influence what we buy. That new gadget, outfit, or trip might be more about fitting in than personal need. Social Media makes us do several things we dont like.

5. Fear of Missing Out (FOMO)

Flash sales and “limited stock” labels tap into our fear of scarcity. This psychological trigger makes us believe we’ll miss a once-in-a-lifetime chance, even when the product isn’t essential.

Why Regret Follows After Spending

Regret happens when there’s a mismatch between what we wanted emotionally and what we needed logically. That shiny new purchase didn’t fix the bad day, the boredom, or the loneliness. Instead, it added guilt or financial stress.

The psychology of spending explains that regret is often our brain’s way of teaching us to slow down, reflect, and reconsider before making the same mistake again.

Read More: Swipe, Spend, Smile… Crash: The Truth About Fleeting Joy

How Understanding the Psychology of Spending Helps You Break the Cycle

Step 1: Recognize Emotional Triggers

Pay attention to your feelings before you shop. Are you tired, sad, stressed, or bored? Awareness is the first step to stopping unnecessary purchases.

Step 2: Delay Gratification

Next time you want to buy something, wait 24 hours. This simple pause can help separate emotional wants from genuine needs.

Step 3: Create a “Feel-Good List” That Isn’t Shopping

Instead of buying, try activities like walking, journaling, or calling a friend. Replacing spending with healthier coping strategies can reduce regret.

Step 4: Set Boundaries With Marketing

Unsubscribe from tempting emails and limit social media scrolling. Marketers are masters at triggering spending impulses, and avoiding their influence is powerful.

Step 5: Budget With Emotions in Mind

Instead of seeing your budget as restrictive, view it as a tool for emotional freedom. Knowing where your money goes removes guilt and increases confidence.

Real-Life Relatable Example

Think about this: You had a tough week and decide to order an expensive meal delivery instead of cooking. It feels great at first. But then you check your bank balance and feel the sting. That’s not just bad budgeting, that’s the psychology of spending at work, using food as comfort.

Recognizing this connection can help you stop the cycle, save money, and still meet your emotional needs in healthier ways.

FAQs

1. What is the psychology of spending?

It’s the study of how emotions, habits, and mental triggers influence our financial choices.

2. Why do I regret purchases so often?

Because emotions drive the purchase, but logic steps in afterward, making you question if it was truly worth it.

3. Can stress really make me spend more?

Yes. Stress is one of the biggest emotional triggers, often leading to “treat yourself” purchases.

4. How can I stop impulse buying?

Try waiting 24 hours before completing a purchase — it gives your logical brain time to catch up.

5. Is retail therapy bad?

Not always, but if it becomes your main coping tool, it can lead to financial problems and regret.

6. Can budgeting help with emotional spending?

Absolutely. A well-planned budget can reduce guilt and allow guilt-free spending on what truly matters.

Conclusion: Taking Control of Your Money Story

At the end of the day, the psychology of spending isn’t about shaming yourself for buying things. It’s about understanding the emotions behind the purchase. Once you recognize those triggers, you can make smarter, healthier financial choices that bring real joy, not regret.

Your money should support your life, not control it. The next time you’re about to spend, ask yourself: Am I buying this because I need it, or because of how I feel right now?