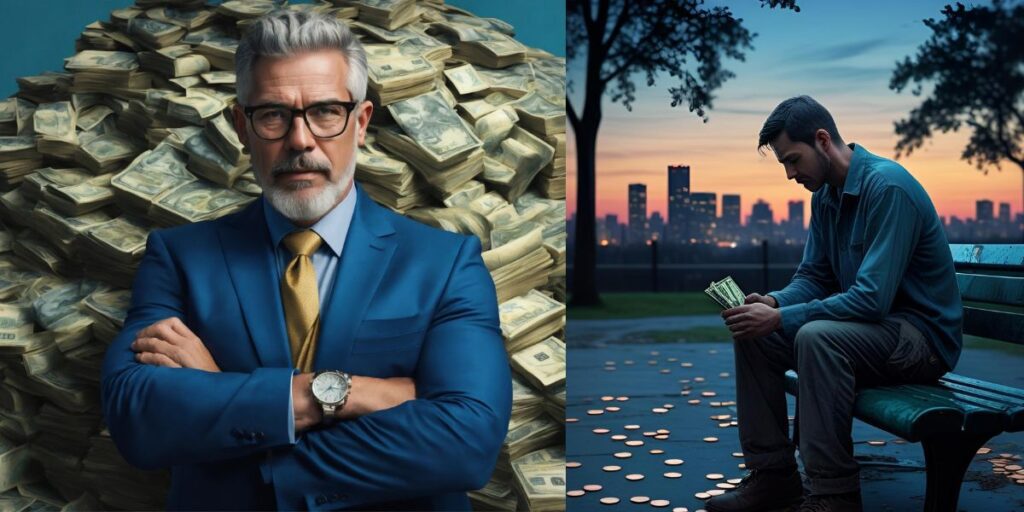

Do you ever feel like you’re caught in a financial rat race? The endless cycle of working, earning, and spending, with little to show for it. You see people on social media talking about “the hustle,” working 80-hour weeks, but you just can’t bring yourself to live that way. You want financial freedom, but you don’t want to burn out to get it. You’re not lazy; you’re smart. That’s why you should have several passive income streams.

A Thick Skin: What Does It take to realize your dream?

You’re looking for a better way, a way to build wealth without the constant grind. The secret isn’t more hustle; it’s creating a system where your money works for you. This is the core principle of passive income, and it’s the foundation of a life where you can earn without always having to work

Busting the Myth: Passive Isn’t Passive at All (Or is It?)

The biggest misconception about passive income is that it’s a “get rich quick” scheme. The truth is, it’s not about doing nothing. The “lazy investor” isn’t lazy; they are strategic. They understand that true wealth is built by making smart decisions and setting up systems at the beginning, so that the return on that effort comes in over and over again, with minimal ongoing work. The initial setup requires effort—researching, planning, and investing, but once the engine is running, your money starts to generate passive income streams on its own. This is about working smarter, not harder.

The Core Philosophy of the “Lazy Investor”

The lazy investor’s philosophy is simple: automate everything, monitor occasionally, and never panic. This means you don’t need to spend hours a day checking stock tickers, managing tenants, or building complex sales funnels. Your goal is to create a set-it-and-forget-it financial machine. This approach frees up your most valuable resource, your time, to be spent on family, hobbies, and personal growth, all while your wealth quietly compounds in the background. True financial freedom is having your money work so hard that you don’t have to. The key to this is understanding how to generate passive income.

Important Read: This One Financial Habit Separates Wealth Builders from Wage Earners

Practical Pillars of Passive Income (with Minimal Effort)

Here are the most straightforward, low-maintenance ways to build a strong foundation for your financial future. These strategies are all about putting in the work once and reaping the rewards continuously

Pillar 1: Dividend Stock Investing

This is arguably the most classic and effortless way to generate passive income. You buy shares of stable, profitable companies, and they pay you a small portion of their profits on a regular basis (usually quarterly). You don’t need to be an expert stock picker. By investing in well-established companies with a long history of paying dividends, you can build a portfolio that pays you consistently.

- The Effort: The only work involved is the initial research to select quality stocks and then the automated process of reinvesting your dividends.

- The Reward: Consistent cash flow that requires no active management. This is the essence of building a genuine passive income stream.

Pillar 2: High-Yield Savings Accounts & CDs

This is the lowest-risk form of passive income. While the returns are not as high as stocks, it’s a guaranteed way to earn money on your savings without any effort at all. With a high-yield savings account or a Certificate of Deposit (CD), you simply deposit your money, and it starts earning interest. It’s a foundational step for any lazy investor’s blueprint.

Next Read: Top 7 Money Traps Millenials Fall Into And How To Avoid Them

Pillar 3: Real Estate via REITs (Real Estate Investment Trusts)

The idea of being a landlord and dealing with leaky faucets and difficult tenants is the opposite of a lazy investor’s dream. Fortunately, you can invest in real estate without any of that hassle through REITs. A REIT is a company that owns and manages income-producing real estate. You buy shares in the REIT, and it passes the rental income to you in the form of dividends.

- The Effort: None. You don’t have to manage property, find tenants, or deal with any of the operational headaches. This is a brilliant way to create a true passive income stream from real estate.

- The Reward: High dividend yields that are paid out regularly.

Pillar 4: Lending and Royalties

For those with a creative or strategic side, this is an excellent path to passive income.

- Peer-to-Peer Lending: You lend small amounts of money to individuals or businesses through a platform, and you earn interest as they pay it back. The effort is minimal once you’ve chosen a platform and set up your initial investments.

- Royalties: If you have a creative product—a book, a song, a photograph, you can earn royalties every time it’s sold or used. The work is all upfront, but once it’s out there, it can generate passive income for years.

The Blueprint in Action: Your Simple Steps

Creating your own passive income machine doesn’t have to be complicated. Follow this simple plan to start building your wealth without the hustle.

- Automate Your Savings: Set up automatic transfers from your checking account to your investment accounts on payday.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Allocate your investments across different asset classes like dividend stocks, REITs, and high-yield savings.

- Monitor, Don’t Obsess: Check your portfolio once a month, not once a day. The key to the “lazy investor” mindset is trusting the system you’ve built and letting it do its work.

Lifestyle Read: Why Smart People Waste the Most Time, And How to Fix It Fast

Your Freedom Awaits

The world will continue to preach hustle culture and 24/7 productivity, but the smartest people are quietly building a different kind of life. They are using the power of passive income to build wealth, not to buy things, but to buy back their time and freedom. This blueprint isn’t a shortcut; it’s a strategic, long-term plan that frees you from the daily grind. It’s about making your money work hard so you don’t have to. By building a solid foundation of passive income, you can finally trade the hustle for a life of intentionality and freedom.

Read at your own rist: Behind Closed Doors: The Alarming Rise of Self Harm Among Teens

Pingback: Top 5 can’t‑miss travel destination picks in Europe (Part 1)

Pingback: 7 Lessons on Crypto and Karma for Digital Wealth: Start Now